LTV Cooling Measure for HDB Flats in 2024, Plus More Grant Support for Low-to-Middle Income First-Time Buyers

Angie See

Last Updated on 08-Aug-2025

The Ministry of Development (MND) and Housing Development Board (HDB) have jointly announced a set of cooling measures for the HDB resale market and additional grants to provide further support to lower-to-middle income first-time home buyers.

Adjustment of Loan-To-Value limit for HDB loans

With effect from 20 August 2024, the Loan-to-Value (LTV) limit for HDB loans will be lowered from 80% to 75%, akin to mortgage loans granted by financial institutions. The revised HDB LTV limit will apply to complete resale applications received by HDB on or after 20 August 2024. A complete resale application is one where HDB has received both the sellers’ and buyers’ portions of the application.

Additional Enhanced CPF Housing Grants (EHG) for lower income families and singles

Separately, to provide more support to lower-to-middle income first-time home buyers, the Government will increase the Enhanced CPF Housing Grant (EHG) quantum for new and resale flats to support first-time home buyers.

The EHG will be increased by up to $40,000 for eligible first-timer families, from the current maximum grant amount of $80,000, up to $120,000. Additionally, EHG for eligible first-timer singles will increase by up to $20,000, from the current maximum grant amount of $40,000 to $60,000.

This is the fourth cooling measure targeted at the HDB market since 2021. The first cooling measure was in December 2021, where LTV for HDB loan was lowered from 90% to 85%. The LTV limit was subsequently reduced to 80% in September 2022.

Possible factors behind the cooling measure implementation

The lower LTV has been put in place as a direct measure to cool the HDB resale market. Here are three key metrics behind the implementation of today’s cooling measure.

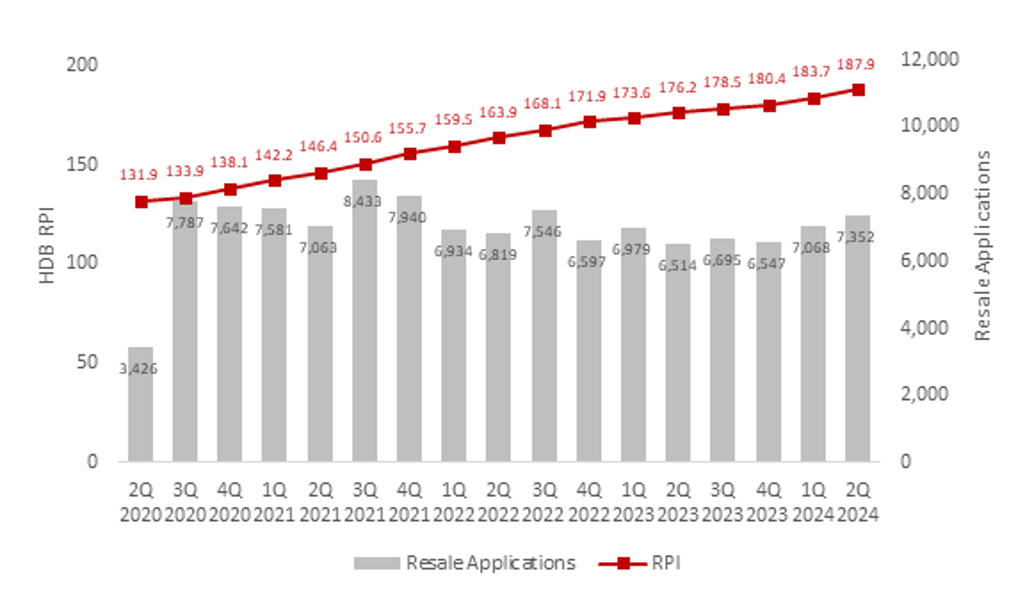

Between 2Q 2020 (start of pandemic) and today, the HDB Resale Price Index (RPI) rose a staggering 42.5%. The number of resale applications have also trended upwards, reporting a 4.0% growth quarter-on-quarter (q-o-q) and 12.9% year-on-year (y-o-y) growth.

Chart 1: HDB RPI and Resale Applications

Source: HDB, ERA Research and Market Intelligence

Source: HDB, ERA Research and Market Intelligence

The most crucial metric would be the number of million-dollar flats resold. In 2020, the market saw only 82 of such flats. But in just first seven months of 2024, we have seen 539 million-dollar flats in the market. Among which, 13 of these transactions were at least $1.5 mil or higher.

The September 2022 cooling measure requires private property owners to wait-out for 15 months after selling their property before they can buy a non-subsidised HDB resale flat. Between 3Q 2022 and 4Q 2023, the resale market saw an average of 112 million-dollar flat transactions each quarter.

By 1Q 2024, coinciding with the first batch of private property owners completing their 15-month wait-out period, the number of million-dollar flat transactions surged to 183, followed by 236 transactions in 2Q 2024.

Chart 2: Million-dollar HDB flat transactions

How will the lower LTV affect homebuyers?

With a lower LTV in place, today’s buyers are expected to fork out a higher deposit. To illustrate, we have provided the following scenarios to help buyers understand the implications of lower LTV.

In both Example 1 and 2, the buyers have combined CPF savings of $150,000, which will require no cash top up for the deposit when buying a 4-room flat. But if they decide to buy a 5-room flat, they will need to top up $20,000 in cash to meet the shortfall in deposit. In the case of these examples, the cash outlay is reasonably manageable by most buyers today.

Example 1: Buying a 4-room HDB flat with sufficient CPF to cover the excess deposit

Example 2: Buying a 5-room HDB flat with insufficient CPF to cover the excess deposit

However, looking at the example below illustrates a possible cash outlay that many buyers of such million-dollar flats are facing.

Example 3: Buying a million-dollar 5-room HDB flat with insufficient CPF to cover the excess deposit

Many of these buyers already need to pay a high Cash-Over-Valuation (COV) amount and may need to provide even more cash if they don’t have sufficient CPF funds to cover the higher deposit.

Which buyers are affected by this LTV change?

We do not expect this change to affect a large proportion of HDB resale buyers since many of them are financially prudent. But there could be a small group of buyers who may be affected by this change.

- Buyers who have little CPF funds will have to fork out more cash going forward.

- Buyers who may have little cash and CPF and are relying on the valuation to reduce their cash outlay.

EHG to increase, offering support to first-time homebuyers

For the eligible Singaporeans, the EHG will be revised to provide additional support for lower-to-middle income households buying new or resale flats. The maximum EHG for First-Timer Families and Singles, depending on monthly household income, will offer them greater help in managing the higher deposit required with the lower LTV limit.

Comparing the current and revised EHG, the lower band of household income will see a significant increase in grants. For First-Timer families that earn less than $5,000 per month, the revised grants will amount to between 40% and 50% more than before. This will provide substantial supports to lower-to-middle income households looking to buy their first home.

Chart 4: Housing Grants for Eligible First-Timer Singles

ERA’s closing comments

Through the implementation of this new cooling measure, it is apparent that the Government recognises financing as an important factor in managing financial prudence among homebuyers.

By lowering the LTV for loans granted by the HDB (which are cheaper at 2.6% compared to bank loan rates), it may indirectly compel buyers to be more conservative when making their offers to purchase HDB resale flats. This may result in a stabilisation of HDB resale prices in the long run.

We are in full support of the Government’s ongoing dedication to ensuring HDB flats stay affordable for Singaporeans. The latest policy tweaks reflect a strong commitment to ensuring that citizens of all demographics have access to affordable housing, which is integral to upholding the social fabric of Singapore.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

ENG

ENG