For almost anyone doing it for the first time, buying a home in Singapore can be a confusing process. Throw in a bunch of acronyms, like ABSD (Additional Buyer’s Stamp Duty) and MOP (Minimum Occupation Period), and things can get baffling real quick.

However, if you’re intending to take out a loan on a new home purchase, two terms that you’ll absolutely need to know are TDSR and MSR.

In their full form, TDSR stands for ‘Total Debt Servicing Ratio’, whereas MSR means ‘Mortgage Servicing Ratio’, and they’re both Government initiatives to promote responsible borrowing.

Below, we explain how TDSR and MSR came about, their purpose, and how to determine your housing affordability using both ratios.

What exactly are TDSR and MSR? And how did they come to be?

Introduced by the Monetary Authority of Singapore (MAS) in 2013, the TDSR is a framework applying to all property loans extended by banks to borrowers. Its rollout is to promote prudency amongst individuals taking loans, so that they don’t end up borrowing more than they could afford.

Therefore, the TDSR, which limits debt repayments to a certain percentage of gross monthly income, is first and foremost a safety net. When the TDSR was first introduced in 2013, borrowers were allowed to spend up to 60% of their gross monthly income on loan servicing. Subsequently, that limit was tightened to 55% in 2021.

Put differently, this means that under TDSR guidelines, a borrower should have a total debt value of under 55% of his or her monthly salary to be able to take out a mortgage.

Similarly, for the MSR, it places a cap on the percentage of monthly income that borrowers can use for mortgage repayments. In 2013, the MSR threshold was set at 30% for HDB flat purchases that are financed by bank loans, and it has stayed that way since.

How are TDSR and MSR applied differently for home purchases?

If there’s a key difference between TDSR and MSR that’s worth highlighting, it’s that TDSR applies to all types of housing loans, whereas MSR applies only to loans for buying an HDB flat OR an Executive Condominium (EC) that still hasn’t completed its MOP.

Hence, supposing that you’re a homebuyer who wishes to take out a home loan for an HDB flat or EC purchase, you’ll have to comply with both the MSR and TDSR limits.

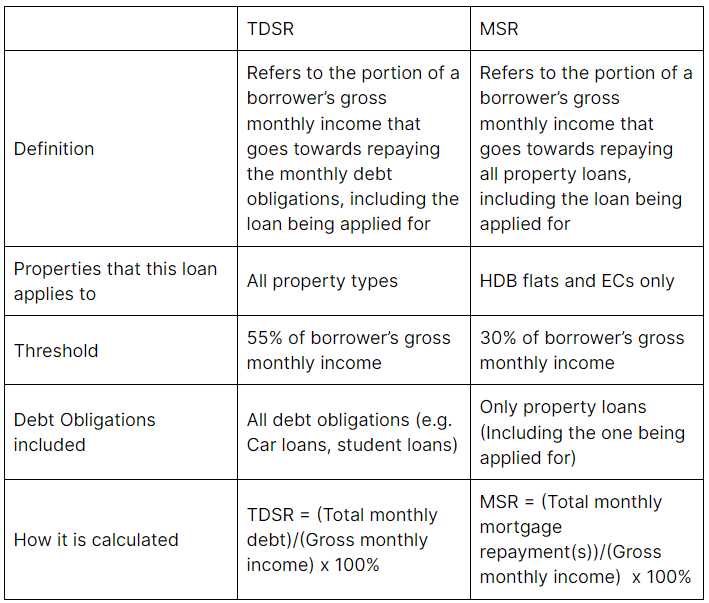

The differences of both ratios are summarised in the table below.

Table 1: Summary of the differences between TDSR and MSR

It’s also worth bringing up (again) that both TDSR and MSR account for different financial considerations. TDSR factors in all of a borrower’s unsettled debt, including loans taken out for housing, cars, education, credit cards, and so forth. In comparison, MSR is more straightforward as it’s solely calculated on a borrower’s monthly income.

For borrowers buying an HDB or EC unit, their household monthly income will first be assessed using the MSR on their loan quantum to calculate the maximum amount they can repay monthly. Thereafter, buyers will be further subject to a second round of assessment, which will consider all their debt repayments are within the TDSR limits. Should the borrowers have outstanding debts such as car loans, it may affect the amount they borrow and they may not get the maximum MSR loan amount.

How do you calculate MSR based on your household income?

In general, a borrower’s MSR can be derived by dividing their total monthly mortgage repayments by their gross monthly household income.

Assuming Party A has a gross monthly income of $10,000, his MSR calculations would be so…

IMAGE MSR

$10,000 x 30% = $3,000

In another scenario, if Party A has an existing debt of $4,000 and a gross monthly income of $10,000, his MSR calculations would be so…

Maximum MSR loan amount = $10,000 x 30% = $3,000

Maximum TDSR loan amount = $10,000 x 55% = $5,500

Maximum MSR loan amount that can be taken to meet TDSR limit = $5,500 – $4,000 (Existing debt) = $1,500

In other words, even though Party A’s maximum mortgage affordability is $3,000 (based on the current MSR threshold of 30%), their existing debt of $4,000 limits their borrowing capacity to just $1,500.

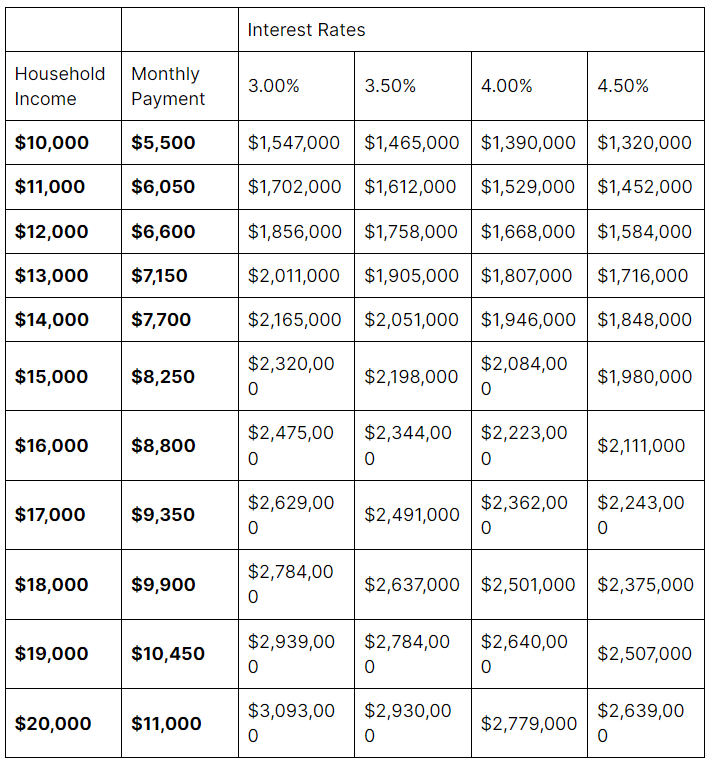

To gauge the estimated loan quantum a household can secure based on MSR, one can refer to the sensitivity analysis table below.

With a monthly household income of $16,000, a family can afford a home of up to $1.01mil, which works out to the price of a 2-room condo in the OCR.

Table 2: MSR Sensitivity Analysis- Based on Value Of Property on Household Income and Mortgage Rates for a 25 Year Loan

Source: ERA Research and Market Intelligence

*Rounded to the nearest thousand

How do you calculate TDSR?

Similar to MSR, it’s possible to derive a borrower’s TDSR with the help of a formula, which is as follows…

So, for instance, if Party B earns a fixed income of $10,000 a month and owes $2,000 in car loans as well as $1,000 in credit card loans, their maximum remaining capacity for monthly mortgage payments, based on the current TDSR threshold of 55%, would be…

Maximum loan based on TDSR limits = $10,000 X 55% = $5,500

Maximum remaining borrowing capacity = $5,500 – car loan ($2,000) – credit card loan ($1,000) = $2,500

However, if a borrower’s income varies from month to month, their TDSR can be slightly trickier to calculate. And that’s because they’re only permitted to use 70% of their gross monthly income for TSDR calculations.

Or as MAS puts it: “financial institutions are required to apply a haircut of at least 30% to all variable income (e.g. bonuses) and rental income”.

Therefore, if we’ve Party C who has a similar debt situation as Party B, along with a gross monthly income of $10,000 – consisting of a fixed component of $7,000 and $3,000 in commissions – their TDSR calculations will look like this…

Maximum loan based on TDSR limits = [$7,000 + ($3,000 X 70%)] X 55% = $5,005

Maximum remaining borrowing capacity: $5,005 – car loan ($2,000) – credit card loan ($1,000) = $2,005

To gauge the estimated loan quantum a household can secure based on TDSR, we can refer to the sensitivity analysis table below.

Under TDSR, a family earning a monthly household income of $16,000 can purchase a home of up to $2.4mil which is a rough cost for a sizable 3-bedroom OCR condo presently.

Table 3: TDSR Sensitivity Analysis– Max Value of property value based on household income and mortgage rates for a 25 Year Loan

IMAGE TABLE 3

The same applies to mortgage equity withdrawal loans too, provided the Loan-to-Value ratio, combined with any other loans secured against the same property, does not exceed 50%.

Lastly, another important term to know is the Loan-to-Value ratio.

Loan-to-Value Ratio

The LTV ratio is the percentage of the property value an individual is allowed to borrow to finance their home mortgage. Implemented by the government, this ratio serves to limit how much money can be borrowed by individuals to ensure the borrower is able to repay all their loans and not over-leverage.

The LTV limit for an individual with no existing housing loans is capped at either 75% or 55%, with a minimum cash down payment of 5% or 10% respectively.

The table below will delineate the differences in LTV limits based on the number of outstanding housing loans.

Table 4: LTV Limits Applied based on Outstanding housing loans

IMAGE TABLE 4

Source: MAS, ERA Research and Market Intelligence

The lower LTV limit should be applied if the loan tenure exceeds 30 years, or 25 years for HDB flats, or if the loan period extends beyond the borrower’s age of 65 years.

For HDBs, the maximum loan an individual can take to finance their flat has been tightened.

With effect from 20 August 2024, the Loan-to-Value (LTV) limit for HDB loans will be lowered from 80% to 75%, akin to mortgage loans granted by financial institutions. The revised HDB LTV limit will apply to complete resale applications received by HDB on or after 20 August 2024. A complete resale application is one where HDB has received both the sellers’ and buyers’ portions of the application.

For applicants who were successful in the June BTO exercise, the LTV limit for their housing loans will not be affected and will remain at 80%.

Keen to learn more about how this applies to your homebuying journey? Or about TDSR and MSR in general? Feel free to speak to an ERA trusted adviser today and a professional financial adviser, and get started on your property journey!

Disclaimer: The information provided here is for general informational purposes only and does not constitute financial advice. Mortgage terms, CPF utilisation, and eligibility criteria may vary depending on individual circumstances, lender policies, and regulatory changes. It is strongly recommended that you seek advice from banks, financial advisors, or relevant authorities to understand how these factors apply to your specific situation before making any financial decisions.

ENG

ENG