The Fed’s Interest Rate Cut is Good News for Singapore Homeowners – Here’s Why

Angie See

Last Updated on 09-Sep-2024

The Federal Reserve (Fed) has finally cut interest rates after keeping them elevated over a prolonged period.

On 18 September 2024, the Fed announced a cut of 50 basis points (bps), lowering its target interest rate range to 4.75% to 5.00%. This marks a decrease from the previous range of 5.25% to 5.50%, the highest in 23 years.

Notably, this is the first rate cut following a series of hikes that began in 2022, which were implemented to combat rapidly rising inflation. This long-awaited decision will impact lending rates by commercial banks, thereby reducing borrowing costs for consumers and business operators alike across various financial products – from mortgages to credit loans.

Market analysts predict further interest rate cuts by end-2024, with an additional 50 bps expected to be shaved off. In addition, a further rate cuts are expected to be announced in 2025. Should these reductions materialise, this will bring the federal funds target range down to 3.25% to 3.50% by the end of 2025.

Hence, if you’re keen on committing to your first (or next) home purchase, these changes could mean lower local interest rates are on the cards. Plus, here’s a breakdown of three key developments you can expect:

1. Lower interest rates could be on the horizon as the Singapore Overnight Average (SORA) is historically influenced by FED interest rate cuts

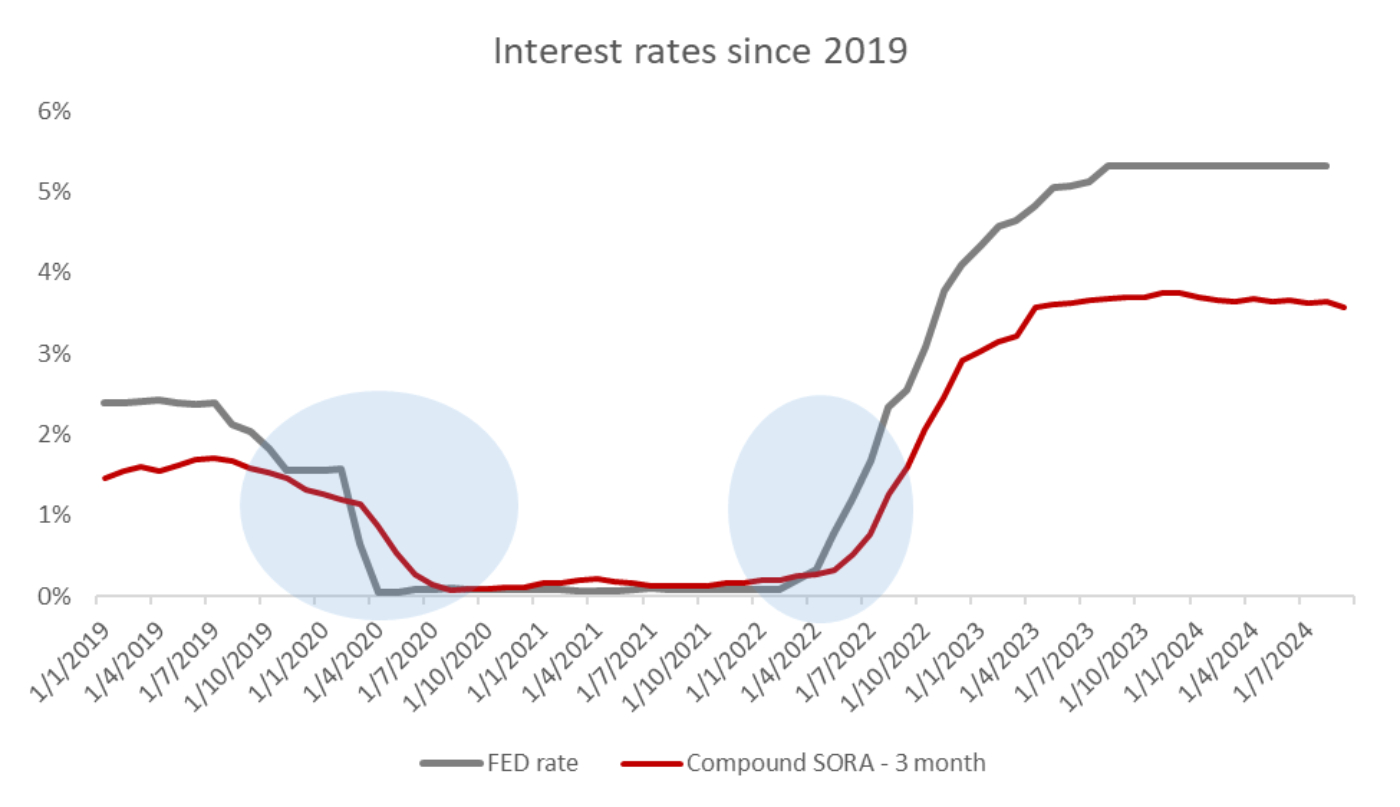

In 2019, as the Fed cut interest rates to address a slowing economy, the 3-Month Compounded SORA (3M SORA), which is used as a benchmark for Singapore home loans, also moved in tandem, dropping from 1.5% in October 2019 to levels below the 1% mark This near-zero low persisted till Q2 2022.

Since March 2023, the Fed has implemented a series of consecutive rate hikes. These increases continued until July 2023 and have remained consistently high since then. Back home, the 3M SORA took on a similar trajectory.

Given the recent Fed rate cut, we could see the 3M SORA taking on a similar direction. Going forward, Fed will continue to base future rate cut decisions on data-driven analysis and implement a measured approach. With that, we can expect a gradual and measured pace of decline in interest rates in the future.

2. For those on a home loan with a floating mortgage rate, your monthly instalment could be lower over the next few months

Given the strong likelihood of local interest rates tracking Fed movements, homeowners with existing floating rate mortgages have good reason to expect favourable news. A corresponding fall in the 3M SORA would offer a silver lining in the clouds, as borrowing costs fall for them.

As it stands, reports in Singapore also confirm that local banks have already “priced in” the effects of the Fed’s latest rate cut. So, should borrowers refinance at this point?

The answer: perhaps. Homeowners should most certainly explore their refinancing options, and in the medium, a floating rate package could be more attractive given the potential rate cuts ahead.

3. The MAS stress test interest rate, used to assess the loan quantum, remains unchanged for now

By using the stress test interest rate, the Monetary Authority of Singapore (MAS) determines how much borrowers can safely borrow for mortgage loans. This measure helps prevent over-leveraging and ensures that borrowers can comfortably handle their monthly repayments in times of elevated interest rates.

Or, put simply, the stress test rate sets an upper limit for loan amounts.

MAS last raised the stress test rate from 3.5% to 4% in September 2022, but some banks are using already using a higher stress test rates of 4.5%. And although there has been no official word regarding a review yet, a potential decrease will allow qualified borrowers to secure a larger loan quantum.

To help you understand what all this means to you, let’s take a look at a case study

Mr and Mrs Tan who earn a monthly household income of $15k is looking to buy their new home.

1. Loan quantum based on stress test rate

Based on a stress test rate of 4.2%, the maximum property price they can afford is $1.53 mil for a $2.25 mil property.

But should the stress test rate fall to 3.5%, they can afford to buy a higher loan of up to $1.65 mil for a $2.45 mil property

After Mr and Mrs Tan have secure their loan quantum, let’s see how the interest rates impact their monthly instalments.

2. Monthly instalment based on interest rate

Assuming a loan of $1.53 mil for a $2.25mil property, Mr and Mrs Tan will be paying up to $6,451 in monthly instalment at an interest rate of 3.00%.

Should interest rates fall to around 2.25% over the next few months, the monthly instalment will correspondingly reduce to $5,858 per month.

In closing

In any event, additional Fed rate cuts, whether now or in the future, could bolster market sentiment down the line, while also paving the way for more housing market activity in 2025.

As a potential homebuyer, you may be wondering if now is the right time to enter the market. We expect any decrease will be on a marginal basis Given the current trend of moderating interest rates, you might also be weighing the advantages of investing in a new property with a strong track record.

Given the competitive nature of the banking industry, we can expect banks to follow each other’s lead in adjusting their interest rates. Now is a good time for those looking to refinance their loans, as you can expect more attractive loan packages to become available.

While some may opt to wait for clearer market trends before making a move, we believe that 2024 could usher in favourable opportunities. If you’ve been planning to invest in one of the many new launches currently available, now could be the perfect time to make a move.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

ENG

ENG